People’s Lobby Draft Fair Tax Brackets Congressional Proposal of 2/15/10

IN THE HOUSE OF REPRESENTATIVES AND SENATE

Proposed for 111th Congress

PROPOSED BILL

To request the Congress enact legislation that will return Fair Tax Brackets to our decimated economy that will help promote freedom, fairness, and economic opportunity by returning IRS tax brackets that existed when America’s middle class and economy grew and prospered.

SECTION 1. SHORT TITLE

Returning Fair Tax Brackets to the IRS Act of 2009

Providing tax revenues to rebuild and grow Middle America

SEC. 2 Current Problem

WHEREAS, in 2008 we had 6 marginal tax brackets topping out at $357,700.

WHEREAS, in 1954 we had 24 marginal brackets and rates ranging from 20 – 91%.

WHEREAS, when we had progressive rates generations ago on the very rich, we built the world’s finest road, utility, education, space, and science infrastructure; and with that came the largest, most educated, and hardest working middle class the world had known.

WHEREAS, today’s wealth accumulation is more concentrated than in 1999, when the richest 1% (about 2.7 million people) has as much to spend after taxes as the bottom 100 million.

TRENDS TO RELIEVE MEGA RICH AND BURDEN AN UPPER MIDDLE CLASS WITH TAXES

WHEREAS, in 1944 the top marginal tax rate on income over $200,000 was 94%.

WHEREAS, in 1954 the top marginal tax rate on income over $400,000 was 91%.

WHEREAS, in 1964 the top marginal tax rate on income over $400,000 was 77%.

WHEREAS, in 1974 the top marginal tax rate on income over 200,000 was 70%, on earned income only it was 50%.

WHEREAS, in 1984 the top marginal tax rate on incomes over $162,400 was 50%.

WHEREAS, this trend, along with the income cap on Social Security taxes and the non-indexing of the Alternative Minimum Tax, has increasingly moved the top federal bracket onto what some consider upper middle income Americans.

WHEREAS, under this skewed tax structure the super rich, those taking home incomes high above the $250,000 top bracket, have controlled increasing amounts of wealth, while the wealth of the middle class and those below has dramatically shrunk.

WHEREAS, in 1994 the top marginal tax rate on incomes over $250,000 was 39.6%

WHEREAS, in 2003 the top marginal tax rate on incomes over $311,950 was 35%.

WHEREAS, in 2008 the top marginal tax rate on income over $357,700 was 35%

WHEREAS, if one assumes an inflation rate of 4% since 1954, then in 2008 the top marginal income bracket would have been $1.2 million.

WHEREAS, the average income of all households in 2000 was $42,700.

WHEREAS, in 2000 the 13,400 households (1/100th of 1%) at the very top had an average income of $24 MILLION, or 560 times the average.

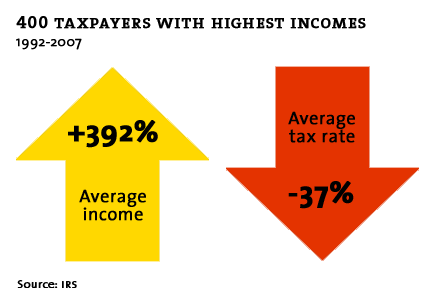

WHEREAS, in 1996 the top 400 taxpayers averaged income of $74 million.

WHEREAS, in 2005 the top 400 taxpayers averaged income of $214 million.

WHEREAS, in 2006 the top 400 taxpayers averaged income of $263 MILLION EACH AND,

WHEREAS, on average, those top 400 paid an effective federal income tax of 17%, much lower than the top proclaimed bracket of 35%.

Sec 3. Rationale for reinstituting Fair Tax Brackets (FTB):

AMERICA’S MIDDLE AMERICAN COMMUNITIES NEED REVENUES

These statistical trends indicate that generations of implementing an inequitable and unjust tax policy has helped accumulate wealth and power by a few. In the meantime, the costs of addressing our many public policy needs has been borne by the growing poor and shrinking middle class.

Especially in today’s economy, revenues are needed to pump economic vitality back into our middle class. It is time to raise revenues from the mega wealthy that can help address community needs, strengthen community infrastructure, and help rebuild America’s middle class, which is the engine that will again drive and rebuild a smarter Americans economy.

Part of the revenues raised from instituting these fair tax brackets will be earmarked and recycled into involving Americans of all economic classes in direct service and learning on national and international needs, so that our long term public policy costs and blunders will be reduced.

Since Vietnam, we have irresponsibly continued funding wars on our national and personal credit cards. The illogical Communist empire fell from the added burden of fighting frugal terrorists whose dad to day life hardened them against a plasticized life. Now our economic system, based on a skewed tax base that rewards gimmickry production and the over comfortably ensconced rich over building and hard working Middle Americans, is poised to have the strategy of frugal terrorists topple what was once a revered, civil, and thoughtful economic system. The FTB reform is part of the process that returns us to a fairer tax system that once helped build a strong and logical economy that earned the world’s respect. While doing so, it set asides some of the revenues raised via the new FTBs to ensure that the AWSC service learning programs builds peace, health, and vision at home and abroad.

Sec 4. Proposal to reinstitute Fair Tax Bracket that grew a robust Middle Class

Therefore, be it resolved that this bill will add two tax brackets the revenues from which will help promote economic freedom, fairness, and growth opportunities forAmerica’s middle, lower, and upper classes.

An IRS tax bracket will be added so that those amounts earned over $5 million annually will be taxed at a 50% flat rate

- An IRS tax bracket will be added so that those amounts earned over $10 million annually will be taxed at a 70% flat rate.

- These will be flat tax rate brackets with no deductions, so that loopholes do not allow the effective tax rate to be significantly less than IRS codes purportedly call for on the rich.

Sec 5. Directed use of a portion of FTB additional revenues:

HEALTHY EARMARKING OF SOME OF THE FTB RAISED REVENUES

Peaceful, productive community and international service builds the experience and character that drives a nation to pursue smart, cost effective, and entrepreneurial public policies.

America’s wealth and ensuing power has been built on the shoulders of Americans of various ethnicities and economic classes. Too often during peaks of American affluence, we forget how America’s national strength resulted from a plethora of individual, community, state, and national efforts.

If the traditional and nontraditional funding mechanisms defined in the AWSC Congressional Proposal should fall short of fully funding the AWSC, this FTB proposal will earmark funds to involve 21 million Americans in voluntary national service at home and abroad via the American World Service Corps (AWSC)Congressional Proposals,

THEREFORE, this proposal will set aside a significant portion of revenues raised from implementing these tax brackets to be assigned to cover the healthy investment for at least the next 27 years in community and international service programs such as those proposed under the American World Service Corps (AWSC) Congressional Proposals, which Congresswoman Woolsey has offered to introduce in the 111th Congress. The key AWSC proposed bill is at

http://www.worldservicecorps.us/world%20service%20key%20proposal%202yr%20volunteer.htm

Sec 6. Impact of earmarking some revenues to robust AWSC service learning

The FTB revenues earmarked to fund AWSC programs will involve many, many more Americans in peaceful, productive service learning. Earmarking such FTB revenues will smarten our long and short-term public policies in every state and while simultaneously building our national character and world image.

Sec 7. Cost:

There is little or no cost in reinstating these fair tax brackets to the IRS Code and changing IRS forms to reflect the changes.

Sec 8. Revenue Flows:

In 2001, the top 1% of households controlled 39.7% of the financial wealth of America. Wealth, and the power that accompanies it, has been growing disproportionately for about a generation. It is time to direct some of that concentrated wealth flows into strengthening America’s physical, moral, and intellectual infrastructure now and for the long term.

The implementation of these tax brackets could yield substantial revenues to involve all Americans in doing good at home and abroad. Such service learning involvement develops the analytical minds that will produce smart short and long term productive solutions, ventures, and businesses that build and maintain economies that benefit all economic classes. While implementing these tax fair brackets, those living with the FTB adjusted net income will still have a very comfortable lifestyle.

Some graphic documentation for this proposed bill can be found at: http://worldservicecorps.us/tax_bracket_reform.htm